Looking for top affordable car insurance companies? Get real-world information and recommendations to find quality coverage at a budget-friendly price.

Looking for top affordable car insurance companies? Look no further! We understand the importance of finding reliable and budget-friendly car insurance without compromising on quality. In this article, we will provide you with real-world information that you need to make an informed decision about your auto insurance. With our helpful insights and recommendations, you can easily navigate through the best cheap car insurance companies. So, buckle up and get ready to discover the perfect insurance coverage for your vehicle!

This image is property of res.cloudinary.com.

Table of Contents

Overview of Affordable Car Insurance Companies

If you’re in the market for affordable car insurance, you’ve come to the right place. In this article, we will provide you with a comprehensive overview of some of the top affordable car insurance companies. Finding the right coverage at an affordable price is essential, and with so many options out there, it can be overwhelming. That’s where we come in, to help you make an informed decision and find the perfect insurance company for your needs and budget.

Factors to Consider When Choosing Affordable Car Insurance

Before we dive into the specific car insurance companies, let’s discuss the factors you should consider when choosing affordable car insurance. The first thing you need to do is assess your needs. Consider the type of coverage you require, whether it’s liability, full coverage, or something in between. This will help you narrow down your options and find a policy that suits your specific needs.

Another crucial factor to consider is the financial stability and reputation of the insurance company. You want to choose a company that has a solid track record and is known for its excellent customer service. Reading customer reviews and checking ratings from independent organizations, such as J.D. Power, can give you valuable insights into a company’s reliability and customer satisfaction.

Additionally, take into account the discounts and benefits each insurer offers. Many insurance companies offer discounts for factors such as safe driving habits, bundling multiple policies, or having certain safety features in your vehicle. These discounts can significantly lower your premiums and make insurance more affordable.

Finally, it’s essential to compare quotes from different insurers to ensure you’re getting the best deal. Each insurance company has its own rating system, and prices can vary significantly between providers. Don’t be afraid to shop around and request quotes from multiple companies to find the most affordable option for you.

Geico

Geico, which stands for Government Employees Insurance Company, is one of the most well-known and affordable car insurance providers in the United States. Known for its catchy commercials, Geico offers competitive rates and a wide range of coverage options.

Geico provides various types of coverage, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also offer additional coverage options, such as roadside assistance and rental reimbursement, to provide you with peace of mind on the road.

One of the advantages of choosing Geico is their user-friendly website and mobile app. You can easily manage your policy, file a claim, and even get a quote online. Geico also offers discounts for military personnel, federal employees, and members of various organizations, making their policies even more affordable.

Progressive

Progressive is another top choice for affordable car insurance. Known for their innovative approach and competitive rates, Progressive has gained popularity across the nation.

Progressive offers a range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also provide additional features such as roadside assistance, loan/lease payoff, and custom parts and equipment value coverage.

One standout feature of Progressive is their Snapshot program. This program allows customers to lower their premiums by using a device or mobile app to track their driving habits. Safe driving behaviors can lead to substantial discounts, making Progressive an attractive option for those who prioritize safe driving.

Progressive also offers discounts for bundling multiple policies, having multiple vehicles on a policy, and even for being a homeowner. Their online platform is easy to use, and you can get a quote and purchase a policy directly from their website. Progressive is a reliable insurance company that provides quality coverage at affordable prices.

This image is property of res.cloudinary.com.

State Farm

State Farm is a well-established insurance provider that offers a range of affordable car insurance options. With a wide network of agents and excellent customer service, State Farm is a popular choice for those seeking reliable coverage.

State Farm’s car insurance policies include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also offer additional features, such as emergency roadside service and rental reimbursement, to ensure you’re protected in any situation.

One of the benefits of State Farm is their extensive network of agents. If you prefer the personal touch of interacting with an agent, State Farm has you covered. Their agents can guide you through the process of choosing the right coverage and provide valuable advice based on your specific needs.

State Farm also offers various discounts, including those for safe driving, multiple policies, and vehicle safety features. Their Drive Safe & Save program allows you to earn discounts based on your driving habits, similar to Progressive’s Snapshot program. State Farm’s reputation for reliable coverage and excellent customer service makes them a top choice for affordable car insurance.

Allstate

Allstate is another trusted insurance company that offers affordable car insurance options. With a range of coverage options and a strong reputation, Allstate is worth considering when searching for the right coverage at a reasonable price.

Allstate’s car insurance policies include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also offer additional features, such as roadside assistance and rental reimbursement, to provide you with peace of mind on the road.

Allstate’s standout feature is their Drivewise program, which allows you to save on your premiums by tracking your driving habits. By utilizing a mobile app or device, you can earn discounts based on factors such as mileage, braking, and time of day you drive. Safe drivers can significantly reduce their premiums through this program.

In addition to their Drivewise program, Allstate offers discounts for factors such as multiple policies, anti-lock brakes, and vehicle safety features. Allstate’s commitment to customer satisfaction and their affordable coverage options make them a top choice for many drivers.

This image is property of www.forbes.com.

USAA

If you are an active or retired military member or a family member of one, USAA is an excellent option for affordable car insurance. USAA, short for United Services Automobile Association, is known for its exceptional customer service and competitive rates.

USAA offers a broad range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also provide additional benefits, such as roadside assistance and rental reimbursement, to ensure you have the coverage you need in any situation.

One of the advantages of USAA is their commitment to military members and their families. They offer exclusive discounts and benefits, including reduced premiums for safe driving and membership and loyalty rewards. USAA has consistently received high ratings for customer satisfaction, making them a top choice for those who have served or are serving in the military.

Nationwide

When it comes to affordable car insurance, Nationwide is a reliable choice. With competitive rates and a range of coverage options, Nationwide has been serving customers for decades and is a trusted name in the insurance industry.

Nationwide’s car insurance policies include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also offer additional features such as roadside assistance, vanishing deductible, and accident forgiveness for qualifying customers.

One unique feature of Nationwide is their SmartRide program, which allows safe drivers to earn discounts based on their driving habits. By using a mobile app or device, you can track your driving behavior and earn rewards for safe driving. This program can significantly lower your premiums and make Nationwide an even more affordable option.

Nationwide also offers various discounts, including those for bundling multiple policies, having multiple vehicles, and being a good student. Their user-friendly website and online quote tool make it easy to find the coverage you need at an affordable price.

This image is property of res.cloudinary.com.

Farmers

Farmers Insurance is another affordable car insurance provider worth considering. With a history dating back to 1928, Farmers Insurance is a well-established company that offers a range of coverage options at competitive rates.

Farmers’ car insurance policies include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also offer additional features, such as roadside assistance and rental car reimbursement, to ensure you’re protected on the road.

One advantage of Farmers Insurance is their flexible payment options. They offer various payment plans to fit your budget, including monthly, quarterly, and semi-annual options. This can be helpful for those who prefer to spread out their payments.

Farmers Insurance also provides discounts for factors such as safe driving, multiple policies, and vehicle safety features. Their responsive customer service and commitment to meeting their policyholders’ needs make them a top choice for affordable car insurance.

Tips for Finding Affordable Car Insurance

Now that we’ve gone through an overview of some of the top affordable car insurance companies, let’s discuss some tips for finding the best coverage at an affordable price:

- Compare quotes from multiple insurance companies to ensure you’re getting the best deal.

- Assess your specific coverage needs and choose a policy that suits you.

- Consider the reputation and financial stability of the insurance company.

- Take advantage of all available discounts, such as safe driving, bundling policies, and vehicle safety features.

- Consider additional features and benefits that may be important to you, such as roadside assistance or rental car reimbursement.

- Read customer reviews and ratings to gauge the level of customer satisfaction with the insurance company.

- Utilize online tools and apps to easily manage your policy and file claims.

- Don’t be afraid to ask questions and seek clarification on any aspects of the policy you don’t understand.

- Maintain a good driving record to qualify for safe driving discounts and avoid any premium increases.

By following these tips and considering the top affordable car insurance companies we’ve discussed, you can find the coverage you need at a price that fits your budget. Remember, affordable car insurance doesn’t mean sacrificing quality or reliability. With the right research and understanding, you can protect yourself and your vehicle without breaking the bank.

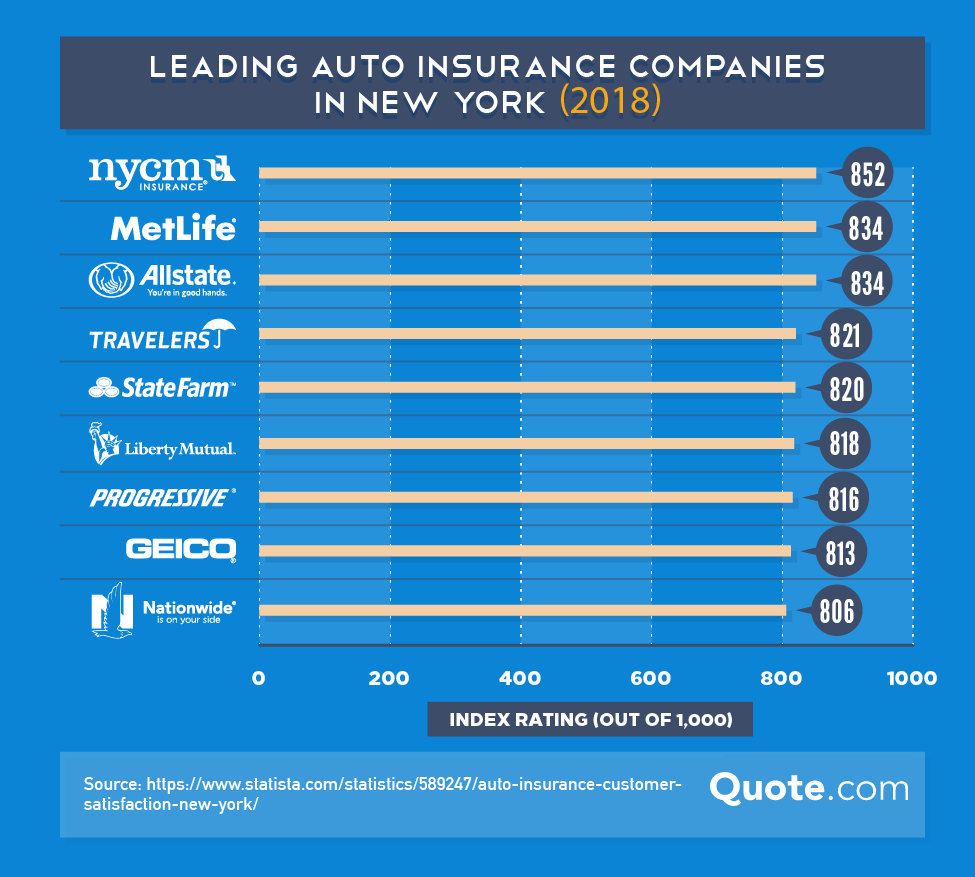

This image is property of www.quote.com