Is it possible to transform nostalgia into a profitable investment? When considering collectibles, it’s a question that many enthusiasts and potential investors might ponder. The allure of collectibles isn’t merely about holding a piece of history or sentiment in one’s hands; it’s about the inherent value and potential return on investment they might offer. In this exploration, we aim to unearth some of the most profitable collectibles, drawing on historical trends, current market insights, and future predictions to guide those intrigued by this unique investment avenue.

With the rising interest in non-traditional investments, understanding the dynamics of the collectibles market is essential. Not only does it require a keen sense of history and the ability to predict trends, but it also demands a comprehensive understanding of the economic factors influencing these items’ worth. So, how do collectibles become profitable, and which ones stand out as the most lucrative?

Table of Contents

Historical Context of Collectibles

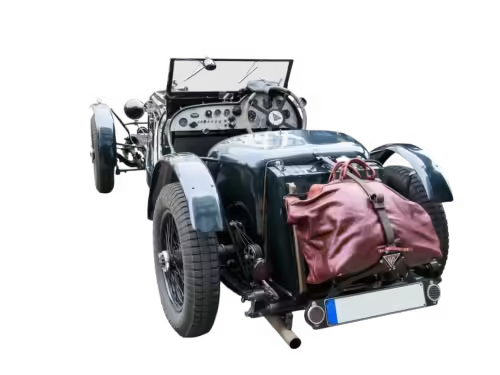

Collectibles have, for centuries, been a part of human culture and investment strategy. From coins and stamps to paintings and vintage cars, the impulse to collect has long been intertwined with an investment inclination. The idea that certain objects could appreciate over time and provide substantial returns has propelled the collectible market to significant heights.

The fascination with collectibles can be traced back to ancient civilizations, where rare coins and unique artifacts were treasured, not just for their beauty but for their rarity and historical significance. With time, these items became symbols of status and wealth, with their value often linked to their scarcity and the stories they carry. A renaissance of sorts occurred during the 20th century with the rise of pop culture, introducing a new wave of collectibles such as comic books, action figures, and trading cards.

Evolution of the Market

As the market evolved, so did the type of items deemed collectible. The late 20th and early 21st centuries saw the rise of new categories, such as video games and sneakers, expanding the collectible universe. These developments have not just diversified the sector but also impacted its profitability. Understanding this evolution is critical for anyone considering venturing into collectible investments.

Current Trends in the Collectibles Market

Today, the collectibles market is a dynamic environment characterized by fluctuating values driven by demand, rarity, and cultural significance. Current trends indicate a blend of traditional and modern collectibles gaining traction, with investors keen on items that offer both aesthetic and financial value.

Key Players and Rising Categories

Traditional items like rare coins and fine art remain robust investment categories. However, newer markets such as NFTs (Non-Fungible Tokens) and digital art have surged, primarily due to technological advancements and a shift in consumer interest toward digital assets.

In recent years, sports memorabilia and vintage fashion have also captured significant attention. For instance, a Michael Jordan rookie card or a rare Hermès Birkin bag can fetch millions, highlighting the intense demand and potential profits these items can generate.

Factors Influencing Value

The value of collectibles hinges on several factors: rarity, condition, historical significance, and cultural impact. These factors collectively influence how a particular item is perceived in the market and can determine its trading price. For seasoned collectors and investors, understanding these influences is key to making informed investment choices.

Key Concepts and Definitions

Rarity and Demand

Rarity is arguably the most critical factor in determining a collectible’s value. An item with limited availability generally commands higher prices, especially if it holds significant demand. For instance, limited edition watches or one-off paintings often see steep appreciation in value.

Condition and Provenance

Beyond rarity, condition plays a pivotal role. An item in mint condition will almost always be more desirable than one that is worn or damaged. Provenance, or the documented history of an item, adds another layer of value, providing assurance to buyers regarding authenticity and historical background.

Defining Worth

In defining a collectible’s worth, appraisers examine market trends, previous auction results, and broader economic indicators. They look at both tangible elements (like physical condition) and intangible factors (such as cultural relevance) to attach a price.

Cases of Profitable Collectibles

Example 1: Rare Coins

Rare coins often serve as a benchmark for collectible investments. The 1933 Double Eagle, a legendary U.S. coin, fetched a record $18.9 million at auction in 2021. This case illustrates the sheer potential of thoughtful investing in numismatics. Factors such as historical significance, mint rarity, and legal circumstances contributed to its staggering valuation.

Example 2: Fine Art

Art has long been a mainstay in the collectibles market, and it’s not without reason. A prime example is Leonardo da Vinci’s “Salvator Mundi,” which sold for over $450 million in 2017. The painting’s authenticity, rarity (as one of the few works by da Vinci in private hands), and its storied past captivated the art world, driving its astronomical sale price.

Comparing Investment Choices

When juxtaposing various categories of collectibles, distinct patterns emerge. For instance, fine art and rare coins often rely on historical allure and provenance, whereas modern art and digital assets may derive value from contemporary relevance and technological novelty. The table below highlights key differences:

| Category | Historical Appeal | Modern Relevance | Rarity and Scarcity | Potential ROI |

|---|---|---|---|---|

| Rare Coins | High | Low | High | High |

| Fine Art | High | Medium | Medium | High |

| NFTs | Low | High | Medium | Variable |

| Sports Memorabilia | Medium | High | High | High |

| Vintage Fashion | Medium | High | Medium | High |

Impact Assessment

The market for profitable collectibles is impacted by various perspectives, ranging from economic trends to cultural changes. A notable impact is seen in how economic downturns might depress generic collectible values while top-tier assets often retain or grow in value, making them attractive investment vehicles. Furthermore, cultural shifts can either elevate an item’s status or diminish its desirability, emphasizing the need for astute market insight.

Effects on the Economy

As tangible assets, collectibles can act as a hedge against inflation, offering investors an alternative when traditional markets struggle. Their fluctuating value can both reflect and impact economic sentiments, illustrating their dual role as both cultural artifacts and financial instruments.

Future Directions and Implications

Predictions on Future Trends

Looking ahead, the growth of digital assets such as NFTs signals a bold new direction. As blockchain technology evolves, more collectors might pivot toward digital art and related collectibles. The interest in sustainability and ethical investment might also guide future trends, favoring collectibles that are both environmentally friendly and culturally sensitive.

Broader Implications

The implications for the industry and society are profound. As collectible markets expand and evolve, they may offer both individual investors and broader economic systems new avenues for growth and enrichment. However, they also challenge traditional notions of value and investment stability.

In wrapping up this exploration of the most profitable collectibles, it becomes evident that while potential rewards can be significant, so too are the requirements for knowledge and discernment. With their intricate historical backgrounds and fluctuating market dynamics, collectibles represent a unique intersection of culture and commerce. Ultimately, the question remains: which collectible will capture both your imagination and your investment interest?

Collectible Investments: 10 Best Assets in 2024, Useful Tips